CardFinder (2024)

Executive Summary

Problem:

Users struggled to confidently choose a credit card due to product complexity, perceived bias, and decision fatigue.

Context:

CardFinder sat at the intersection of editorial trust, personalization, and affiliate monetization, making recommendation quality and transparency business-critical.

My Role:

Senior Product Designer leading UX strategy and end-to-end experience design in close partnership with Product, Engineering, Content, and Legal.

Outcome:

Launched a scalable recommendation experience that reduced decision anxiety, increased qualified engagement with reviews, and preserved long-term trust.

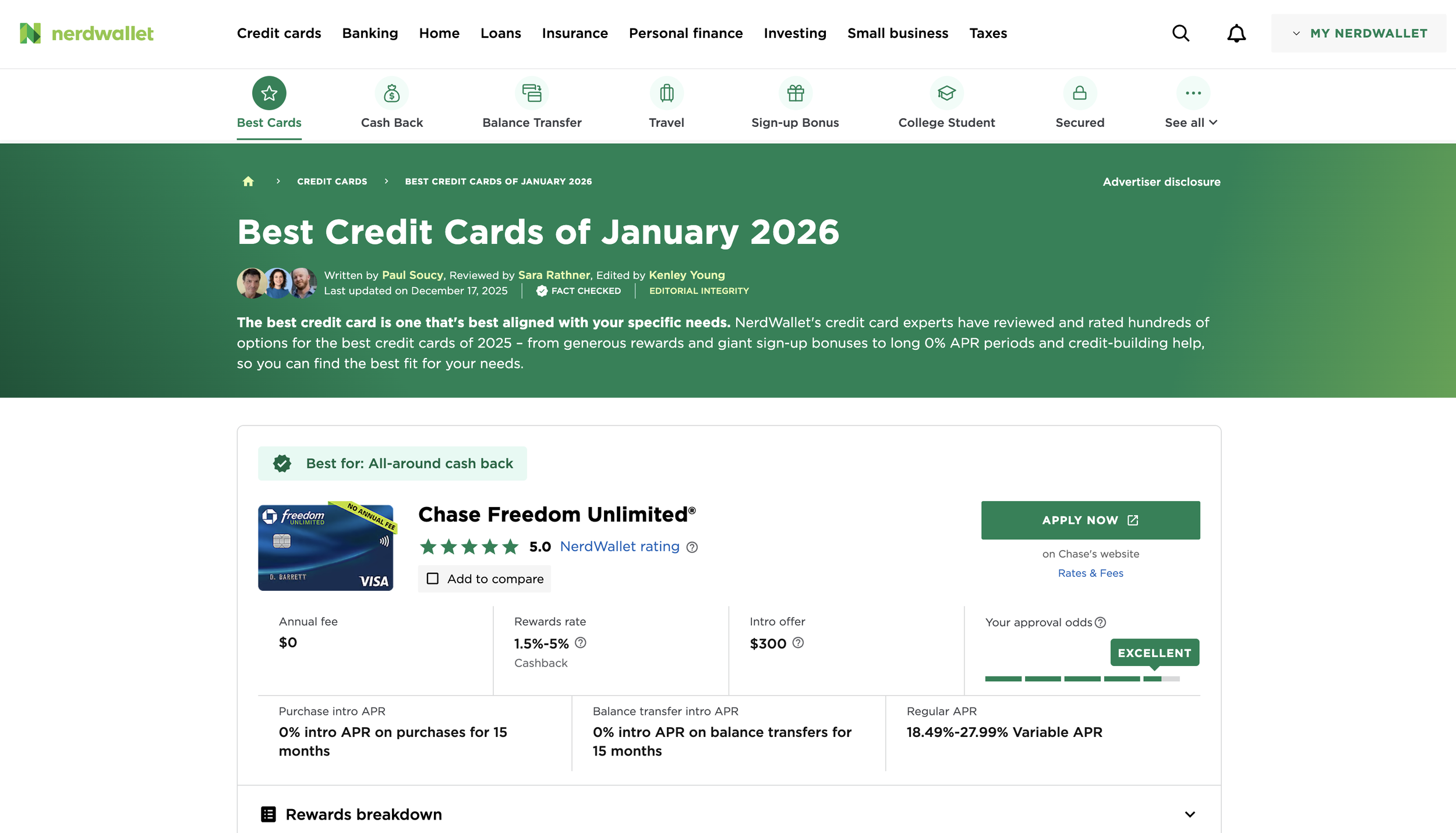

Problem & Business Context

NerdWallet’s credit card ecosystem relied heavily on editorial reviews and comparison pages, but many users still felt overwhelmed deciding where to start.

CardFinder was designed to:

Reduce decision paralysis

Help users narrow options quickly

Route users into high-intent editorial content

From a business perspective, it needed to drive monetization without compromising credibility; a non-negotiable constraint.

Why This Was Hard

Key challenges included:

Trust vs. optimization: recommendations could not feel biased or sales-driven

Explainability: users needed to understand why cards were shown

System constraints: only fully reviewed, editorially approved cards were eligible

Scale: the solution needed to work across many card categories and future products

Over-optimizing for conversion risked long-term brand trust.

Approach & Strategy

Rather than building an opaque “best card” engine, we focused on guided clarity.

Design principles:

Trust over persuasion

Progressive disclosure

Explainable recommendations

Optional depth for cautious users

The goal was not to decide for users—but to help them decide confidently.

Design Solution

CardFinder is a guided recommendation flow, not a one-click decision tool.

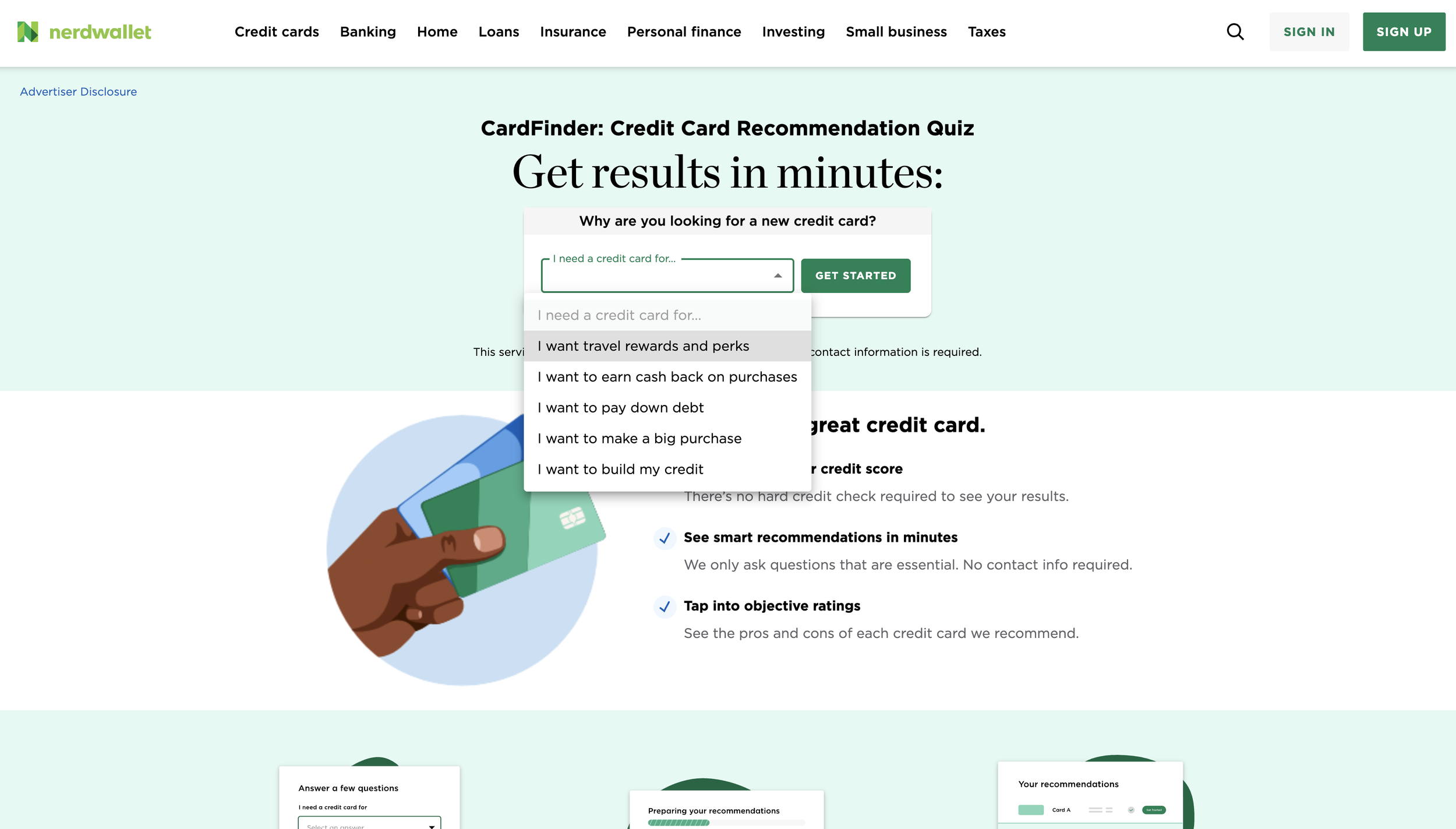

Quiz Experience

5–7 lightweight, goal-based questions

Focused on intent and preferences, not sensitive data

Designed to feel conversational and fast

Recommendation Model (UX Layer)

Hard eligibility filters

Soft scoring across rewards, fees, and use cases

Editorial approval as a gating requirement

Sponsored relationships never overrode relevance.

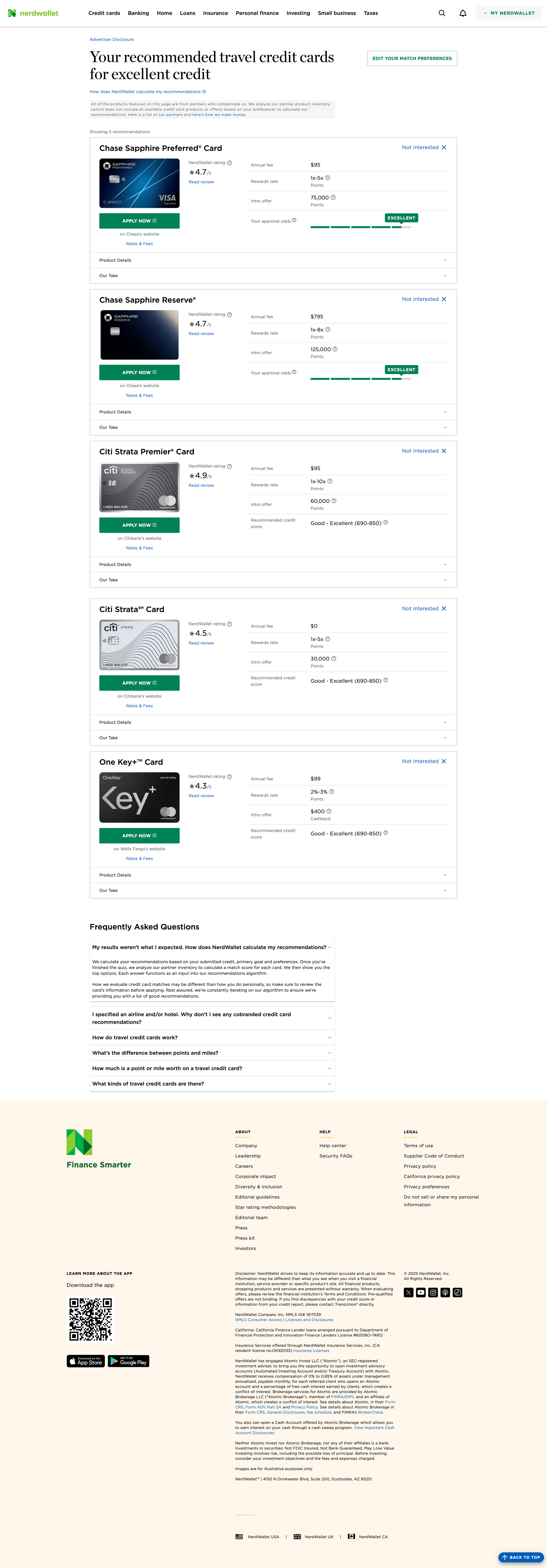

Results Experience

The results page functioned as the primary trust moment:

3–5 strong options instead of a single “winner”

Clear explanations for why each card matched

Balanced pros and cons

Direct paths into full editorial reviews

We intentionally avoided urgency language or aggressive CTAs.

Impact & Outcomes

Post-launch iteration showed:

Higher quiz completion rates

Deeper engagement with review content

Improved downstream conversion despite fewer hard pushes

Strong qualitative trust feedback

CardFinder became a foundational discovery entry point, not a campaign funnel.

Reflection

In high-stakes financial decisions, great design doesn’t remove uncertainty; it helps users navigate it with confidence.

CardFinder succeeded by prioritizing respect, clarity, and trust over short-term optimization.

Thank you for reading. If you’d like to learn more about my design process, please feel free to contact me directly at design@charronmatthews.com — take care!